In the realm of small business management, bookkeeping and accounting are essential yet often time-consuming tasks. However, with advancements in technology, small businesses now have access to powerful tools and accounting software solutions that can streamline and simplify these processes.

At least 40% of all businesses will die in the next 10 years… if they don’t figure out how to change their entire company to accommodate new technologies.

John Chambers, Cisco

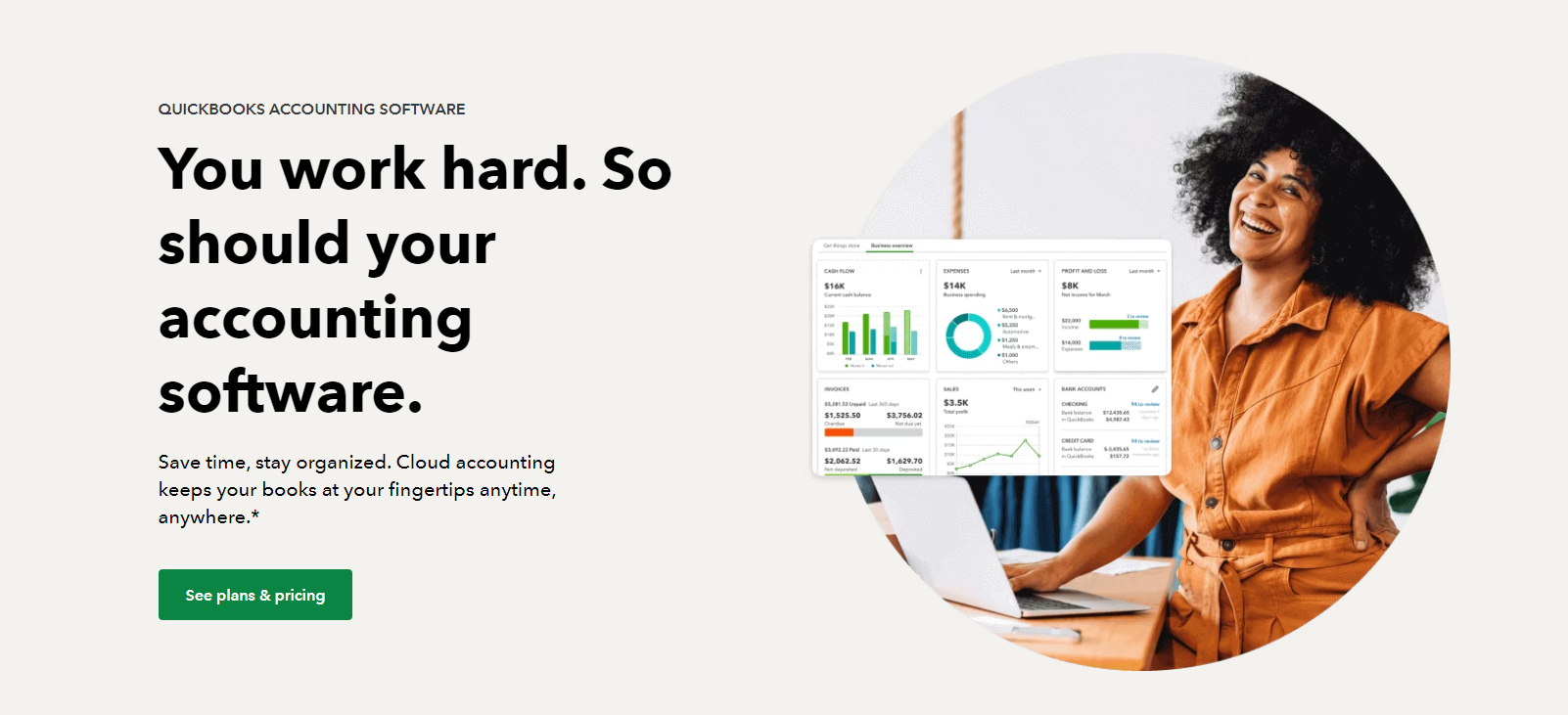

In this article, we’ll explore the advantages of leveraging technology for bookkeeping and accounting processes and delve into why QuickBooks emerges as a top choice for small businesses seeking efficiency, accuracy, and financial transparency.

Advantages of Leveraging Technology for Bookkeeping and Accounting Processes

1. Accounting Software for Enhanced Efficiency and Time Savings

Automation of Repetitive Tasks:

Technology-enabled bookkeeping and accounting software, such as QuickBooks, automate many repetitive tasks that were traditionally performed manually. From data entry and invoice generation to bank reconciliations and financial reporting, automation reduces the time and effort required to manage financial records, allowing small business owners to focus on core business activities.

Streamlined Workflow Processes:

By digitizing and centralizing financial data, technology streamlines workflow processes and facilitates collaboration among team members. With cloud-based solutions like QuickBooks Online, authorized users can access real-time financial information from anywhere with an internet connection, enabling seamless collaboration and decision-making.

2. Accounting Software for Improved Accuracy and Data Integrity

Minimization of Human Errors:

Manual bookkeeping and accounting processes are prone to human errors, which can lead to discrepancies in financial records and reporting. Technology-driven solutions like QuickBooks leverage automation and built-in validation checks to minimize errors and ensure data accuracy, providing small businesses with reliable financial insights for informed decision-making.

Data Security and Compliance:

Maintaining the security and integrity of financial data is paramount for small businesses. Technology-enabled bookkeeping and accounting software offer robust security features, such as data encryption, multi-factor authentication, and regular data backups, to safeguard sensitive financial information from unauthorized access and data breaches. Additionally, platforms like QuickBooks adhere to industry-specific compliance standards, providing small businesses with peace of mind and regulatory compliance.

3. Accounting Software for Enhanced Financial Visibility and Reporting

Real-Time Financial Insights:

Technology-driven bookkeeping and accounting software provide small businesses with real-time visibility into their financial performance. With features like customizable dashboards, interactive reports, and key performance indicators (KPIs), platforms like QuickBooks enable small business owners to monitor cash flow, track expenses, and analyze revenue trends with ease, empowering data-driven decision-making and strategic planning.

Tailored Reporting and Analysis:

QuickBooks offers a wide range of customizable reports and analysis tools that cater to the unique needs of small businesses. Whether it’s generating profit and loss statements, balance sheets, or cash flow forecasts, small business owners can easily customize reports to reflect their specific business metrics and goals. Additionally, advanced reporting features allow for in-depth analysis and trend identification, enabling small businesses to identify opportunities for growth and optimization.

Why Small Businesses Should Use QuickBooks

1. Integration with Third-Party Applications

QuickBooks seamlessly integrates with a variety of third-party applications commonly used by small businesses, such as payment processors, e-commerce platforms, and payroll services. This integration streamlines data entry and eliminates the need for manual reconciliation, saving time and reducing the risk of errors.

2. Scalability and Flexibility

As small businesses grow and evolve, their accounting needs may change. QuickBooks offers scalable solutions that can adapt to the evolving needs of small businesses, from basic bookkeeping tasks to advanced financial management and reporting. Whether it’s upgrading to a more robust plan or adding additional features as needed, QuickBooks provides small businesses with the flexibility to scale their accounting processes according to their growth trajectory.

3. Dedicated Customer Support and Training Resources:

QuickBooks offers comprehensive customer support and training resources to help small businesses get the most out of their software. From live chat support and online tutorials to in-person training sessions and webinars, QuickBooks provides small business owners with the guidance and assistance they need to navigate the software effectively and maximize its capabilities.

4. Access to a Thriving Community:

QuickBooks boasts a vibrant community of users, accountants, and industry experts who share insights, best practices, and troubleshooting tips. Through online forums, user groups, and networking events, small business owners can connect with peers and professionals to exchange ideas, seek advice, and stay updated on the latest developments in bookkeeping and accounting.

Conclusion

In conclusion, leveraging technology for bookkeeping and accounting processes offers numerous advantages for small businesses, including enhanced efficiency, improved accuracy, and enhanced financial visibility. With its robust features, seamless integration capabilities, and scalability, QuickBooks emerges as an indispensable tool for small businesses seeking to streamline their financial management processes and achieve long-term success.

By embracing technology-driven solutions like QuickBooks, small businesses can unlock new opportunities for growth, innovation, and financial transparency in today’s competitive business landscape. Whether it’s automating repetitive tasks, ensuring data accuracy, or gaining real-time financial insights, QuickBooks empowers small businesses to take control of their finances and drive sustainable growth.

Sign up for your QuickBooks account now using our link here and get 75% off for the first six months of your subscription!